Experience

Intelligent

Commerce

Enrich, understand, and activate all your customer, product, and content data in our Commerce Experience Platform (CXP) to personalize every shopping experience and increase your online revenue

Get a demo

Commerce experience

management made easy

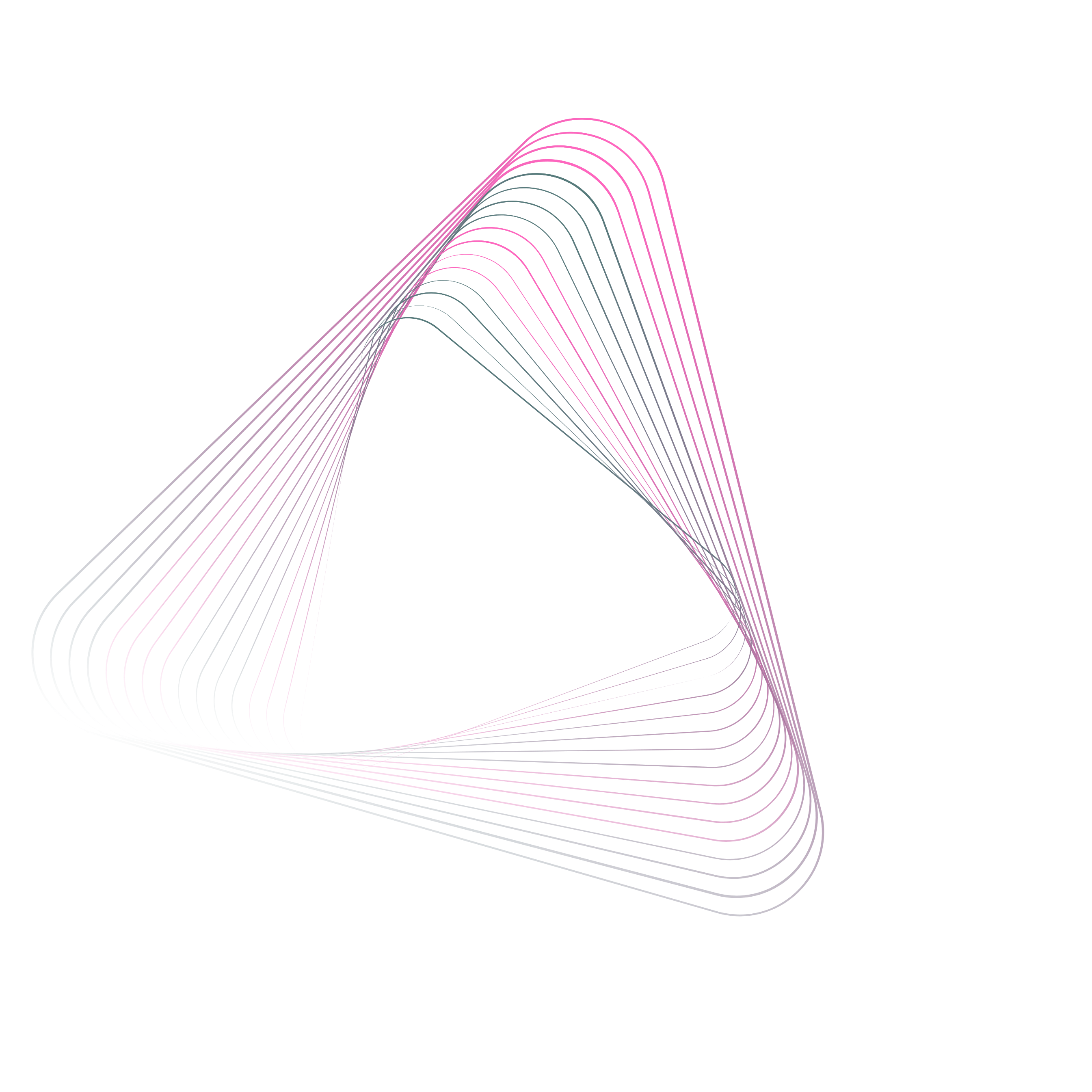

Intelligent commerce

starts with experience.AI™

Combining artificial intelligence, business intelligence, and dynamic audience segmentation and targeting, experience.AI™ is the heart of our CXP. Collecting and unifying intent-rich data so you can use it in your site search, product recommendations, merchandising and more, experience.AI™ is the key to delivering intelligent commerce experience that increase revenue.

Turn commerce data into online revenue with our Experience Clouds

Win more customers, reduce the cost of acquisition, improve lifetime value, and increase your online revenue—all with enterprise-grade personalization, search and discovery, and UGC modules in our Product Experience and Content Experience Clouds

Product Experience Cloud

Personalized Search Category Merchandising Product Recommendations Dynamic Bundles Personalized EmailsContent Experience Cloud

Content Personalization Behavioral Pop-Ups UGC Publisher Center Ambassador Builder

Revenue-generating

commerce

experiences

View all case studies

Why 2,000+ global brands choose us

for commerce experience

Integrations

that support

your tech stack

Explore integrations