New research: How consumers believe fashion retail should tackle the returns crisis

For a long time, free returns in online fashion has been industry standard, shifting from a point of differentiation to a minimum expectation. But with return rates fiercely escalating, the cost to both brands and the environment is forcing the industry to rethink its policies in maintaining both profitability and credibility.

In this article, we explore why returns are posing a greater threat to fashion retailers, and pre-release new consumer research to help fashion merchants understand consumers’ perspectives on the topic of returns—and crucially, how they believe fashion retailers can prevent them.

Why returns are posing a greater threat to merchants today

The costs of the involved transportation, labor, and processing that returns demand have rocketed recently, which, coupled with supply chain bottlenecks, makes the perfect storm for merchants’ financial vulnerability.

This cost implication is only compounded by the actual rate of returns soaring. Increased flexibility with payment options, for example (in particular, Buy Now Pay Later models) has paved the way for customers to buy with the intent of returning much of their orders.

With returns costing fashion retailers as much as 21% of a product’s order value, brands are taking aggressive financial hits and battling to handle reverse logistics.

And money’s not the only burning issue. Soaring returns mean an even greater environmental impact. To illustrate: annual carbon dioxide emissions from transporting returned goods in the US alone is estimated as comparable to having 3 million more cars on the road!

With mounting financial vulnerability and stacking pressures of social responsibility, fashion brands alike have begun tightening their returns policies to fight back. High street giants, Zara and Boohoo, are among the first to start charging shoppers to return items, for instance, and it’s predicted much of the industry will follow suit, however they rationalize it.

Though exactly how these fashion retailers are attempting to tackle the plague of returns is a topic that’s under scrutiny and sparked much debate. Analysts are deliberating how the choices of Zara and Boohoo will play out in these brands’ metrics, whether the wider industry will take notice, what the extent of customers’ environmental and business sympathies will be, among other moot points.

Though one thing is clear: it’s vital fashion retailers listen to their customers if they’re considering changing their returns policies—especially if such changes come at a cost to the customer. The likes of price, even more so with the cost of living crisis, could well be a sticking point for most.

That’s why we’re pre-releasing relevant findings of a recent survey we commissioned for our upcoming Sustainability in Fashion report. Illuminating key insights on consumer attitudes towards the hot topic of product returns and how to prevent them, if you’re a fashion retailer suffering from the returns crisis, you don’t want to miss this.

NEW RESEARCH: What customers think about the returns crisis

We commissioned a survey of just over 2,000 US and UK consumers on the topic of Sustainability in the Fashion industry, which included a selection of questions about ecommerce returns specifically.

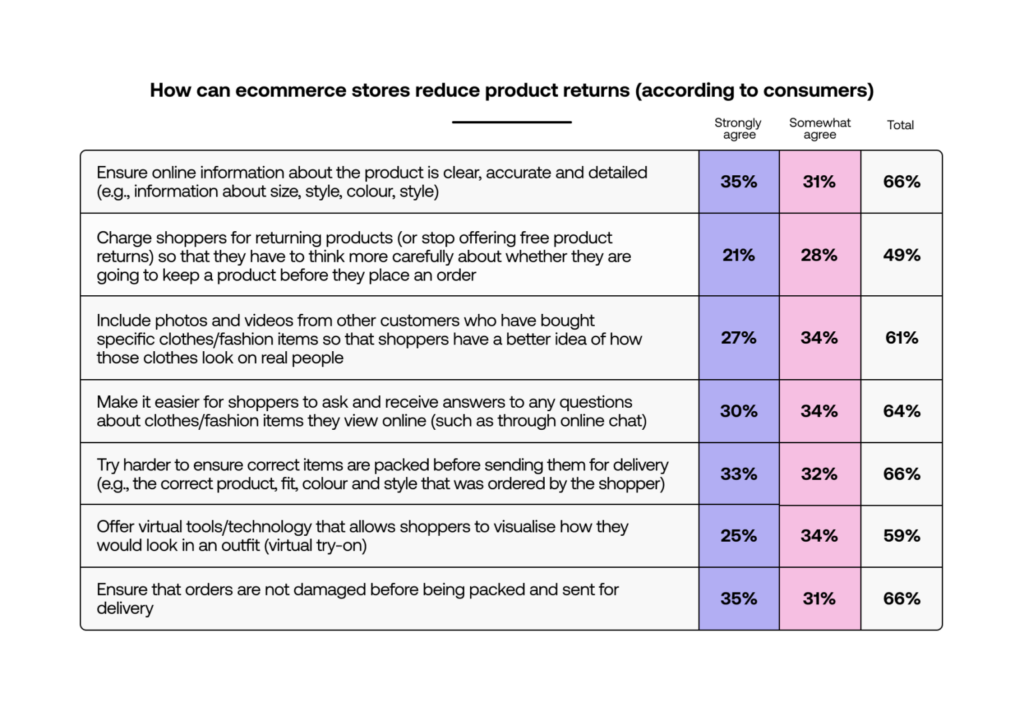

One particular finding shone from a group of responses on what consumers believe fashion retailers can do to prevent returns—the secret sauce every fashion retailer is now seeking with returns costing $761B in 2021 alone and U.S. returns rates are predicted to rise by as much as 30% in 2022.

What stood out was that 61% of respondents agreed returns could be reduced if fashion retailers used customer photos and videos on their ecommerce stores. When we consider this stat alongside earlier research that highlights how happy consumers are for fashion brands to use their post-purchase images within their marketing (with 58% saying they’d permit them to), the opportunity to leverage user-generated content seems a promising way of combatting this.

Interestingly, the results from these questions also showed that the idea of charging shoppers for returns (or stopping to offer free product returns) was the only suggestion with which less than half of the respondents agreed would be effective in reducing returns (with 49% agreeing either somewhat or strongly). While it is encouraging for fashion retailers to see that the majority of respondents believe in the range of suggestions of what merchants can do to prevent returns, this stat does emphasize that requiring additional payouts from customers is something customers don’t want to encourage, and serves as a reminder to retailers to be mindful of charging—especially given the cost of living crisis.

Other findings confirmed consumers are definitely conscious of the environmental impact that ecommerce returns have. For instance, respondents were more than twice as likely to agree that returns are bad for the environment than disagree (49% v 17%) on the basis that returns waste fuel, packaging and other resources.

Similarly, respondents were more than twice as likely to agree than disagree (46% v 17%) that returns are bad for the environment on the basis that they end up being destroyed or sent to landfill sites.

Want more insights? Get notified of our full report’s release

The data we shared in this article is a fragment of the findings of a broader survey on consumer attitudes to sustainability in fashion retail, which will be released later in 2022. Be the first to get your hands on the full report by registering for notification of release over this way.

About the research

Nosto commissioned international market research consultancy, Censuswide, to conduct an online survey of a nationally representative sample of 2,000 consumers (1,000 in the US and 1,000 in the UK). The survey was conducted between 13 June and 16 June, 2022.